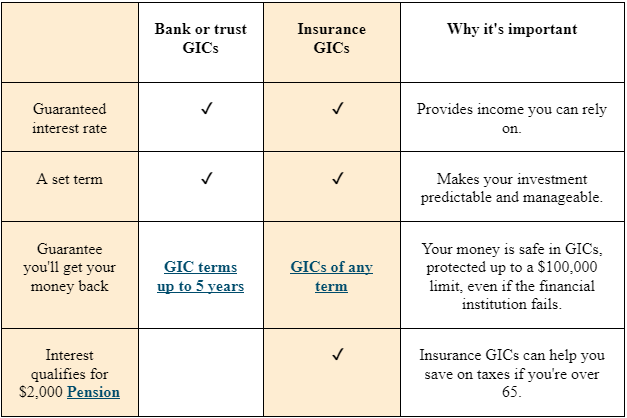

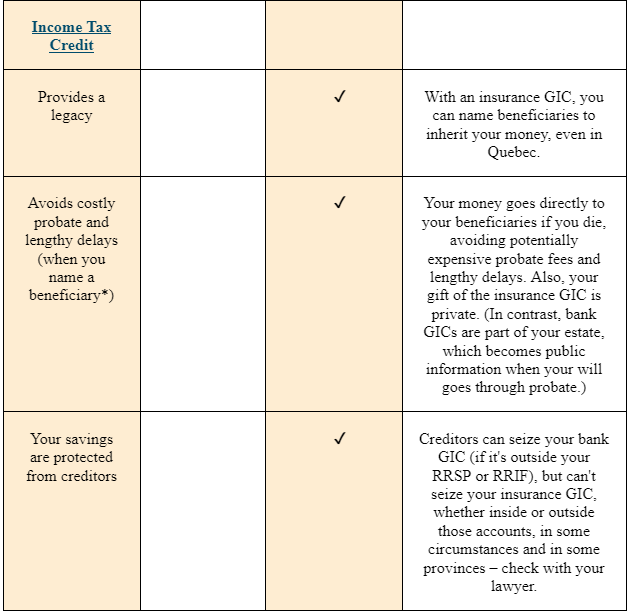

When I went looking for a secure investment, I discovered that all GICs are not created equal — insurance GICs have important, additional benefits.

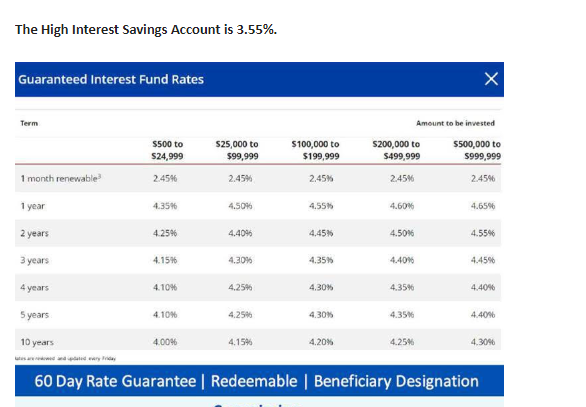

Like many savers and investors, I put some of my money in guaranteed investment certificates (GICs) because they give me stability and security in an uncertain world. GICs pay a guaranteed rate of return – usually more than what you would get from a savings account, but less than the potential returns from other investments such as mutual funds – after a fixed period, or term. (If you are from outside Canada, you may know them as “term deposits.”) Unlike a deposit in a savings account, you can’t withdraw your money from a GIC before the term is up, or you won’t get the guaranteed rate.

Canadians usually buy GICs at banks or trust companies. But I did some homework and discovered that an insurance GIC (sometimes called “accumulation annuities”) can include some important benefits that you don’t get with a GIC from a bank. Let me show you what I mean:

“Many Canadian savers and investors are unaware of insurance GICs,” says Kristina Hay, Product Manager of Guaranteed Products at Sun Life Financial. “They’re really a hidden gem that can provide helpful benefits to many, many people who want guaranteed income.”

Insurance GICs really are “GICs with benefits.” A financial advisor licensed to sell insurance products can provide you with advice on how to build them into your financial plan.